On November 10, 2025, the Brazilian Central Bank (“BCB”) published BCB Resolutions 519, 520, and 521 (collectively, the “New Rules”), which address: (i) the provision of virtual asset services in Brazil; (ii) the authorization process for rendering such services; (iii) the use of virtual assets in the Brazilian foreign exchange market; and (iv) the use of virtual assets in international transactions.

Below is a summary of the main points addressed by the new regulations.

I. Concept of virtual asset

Brazilian law1 defines a virtual asset as a “a digital representation of value that can be traded or transferred electronically and used to make payments or for investment purposes.” The following, however, are expressly excluded from this definition: (i) the Braziliannational currency and foreign currencies; (ii) electronic money, as defined in specific legislation; (iii) instruments that grant the holder access to specified products, services or related benefits, such as loyalty program points and rewards; and (iv) representations of assets when the issuance, bookkeeping, trading, or settlement is governed by law or regulation, such as securities and financial assets.

II. VASP-C: concept and types

The New Rules introduce the concept of a virtual asset service provider company (“VASP-C“), defined as a company that, once authorized by the BCB, may offer services under three types of business models:

| Types | Description of activities |

| Intermediary | Exclusively, on behalf of third parties, an intermediary may, individually or cumulatively: (i) purchase newly-issued virtual assets, individually or as part of a syndicate with other authorized companies; (ii) buy, sell, and exchange virtual assets; (iii) manage portfolios of virtual assets or portfolios composed of virtual assets, securities, financial assets, and other financial instruments permitted under specific regulations; (iv) act as a fiduciary agent in transactions in the virtual asset market; (v) conduct virtual asset staking transactions; (vi) provide virtual asset services in the foreign exchange market; and (vii) execute other activities expressly authorized by the BCB.2 |

| Custodian | Exclusively, individually or cumulatively, a custodian may execute: (i) the custody and control of instruments that affect the exercise of rights and benefits related to the virtual asset, such as private keys; (ii) thetimely updated description of the virtual asset position of each type of asset of the client or user of the custody agreement, as well as the timely reconciliation of this position with the relevant information available in systems based on distributed-ledger technologies or similar; (iii) compliance with the movement instructions issued by the holder of the virtual asset or the person to whom the power to act in the holder’s interest has been delegated, as well as the preservation of these instructions; (iv) treatment of events affecting the virtual asset; and (v) creating and extinguishing liens and encumbrances; and (vi) managing data and information relevant to the execution of any of the activities described in items “i” to “iv” with respect to the holder and their virtual assets in custody. |

| Broker | A broker is authorized to perform, cumulatively, both intermediation and custody activities involving virtual assets. |

In addition to VASP-Cs, the BCB may authorize the following institutions to act as intermediaries and custodians: (i) commercial banks, investment banks, universal banks, and the Caixa Econômica Federal; and (ii) broker-dealers, and foreign exchange brokerage firms (“FX Brokers”).

III. VASP-C: main rules and obligations

The main rules and obligations applicable to VASP-Cs are summarized below:

| Formation | – VASP-Cs may be formed as limited liability companies or corporations; – VASP-Cs must be formed in Brazil, have their headquarters and management located in the Brazilian territory, and be subject to Brazilian law and authorities; and – A VASP-C cannot be formed with a sole partner that is an individual. |

| Name | VASP-Cs: – Must include the expression “Virtual Asset Service Provider Company” (Sociedade Prestadora de Serviços de Ativos Virtuais) in their corporate name; and – May not use corporate names that could mislead customers or users regarding their type of business model, or that contain terms or fragments of terms related to unauthorized activities or suggesting such activities, whether in Portuguese or in a foreign language. |

| Minimum Capital | VASP-Cs must comply with the minimum paid-in capital and net-worth requirements established in the applicable regulations.3 |

| Governance | VASP-Cs must have at least three officers responsible to the BCB for ensuring compliance with applicable regulations. |

| Other rules | VASP-Cs must adopt rules and controls addressing, among other matters: i. segregation of financial resources and virtual assets;4 ii. cybersecurity; iii. internal controls, risk management, and prevention and combating of money laundering, countering the financing of terrorism, and countering the financing of proliferation of weapons of mass destruction (AML/CFT/CPF); and iv. customer risk-profile assessment. |

IV. VASP-C: authorization processes

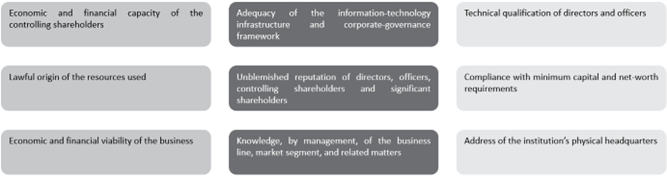

In general terms, the BCB will assess within the VASP-C process for authorizing the start of operations the same requirements currently applicable to broker-dealers and FX Brokers, as summarized below:

In addition to the authorization required for the start of operations of an VASP-C, the following events also require approval from the BCB: (i) changes in the type of business model; (ii) transfer or change of corporate control; (iii) amalgamation, spin-off or merger of the VASP-C; (iv) corporate transformation; (v) investiture and exercise of duties by elected or appointed directors and officers; (vi) changes to the amount of the share capital; (vii) changes in the corporate name; and (viii) changes in the corporate purpose to another type of institution that is either a broker-dealers or an FX Broker.

V. Use of virtual assets in the Brazilian foreign exchange market

Under the New Rules, the provision of virtual asset services involving the following activities or transactions is now included within the scope of the foreign exchange market:

- international payment or transfer made with virtual assets;

- transfer of virtual assets to or from a customer of a virtual asset service provider to fulfill an obligation arising from the international use of a card or other electronic payment instrument;

- transfer of virtual assets to or from a self-custody wallet that does not involve an international payment or transfer with virtual assets; and

- the purchase, sale, or exchange of virtual assets referenced in fiat currency.

In addition, VASP-Cs may be authorized by the BCB to conduct the above transactions, and transactions with cash, whether in domestic or foreign currency, are prohibited. In particular, an international payment or transfer with virtual assets may not exceed US$ 100,000 when the counterparty is unauthorized to operate in the foreign exchange market.

VI. Use of virtual assets in international transactions

The New Rules expressly permit the use of virtual assets in foreign direct investments, foreign credit transactions, and Brazilian investments abroad. For example, these rules expressly admit the use of virtual assets to pay in a share capital and repay a foreign credit transaction.

VII. Effective date and transition period

In general, the main changes introduced by the New Rules will take effect on February 2, 2026 (“Effective Date“).

Entities bearing evidence of having started activities compatible with those of VASP-Cs by the Effective Date must apply for the authorization to operate on or before 260 days following such Effective Date.

Our Financial Services group is available to clarify any aspect of the New Rules.

1. Article 3 of Law 14,478, dated December 21, 2022.

2. In addition to the activities mentioned above, virtual asset intermediaries may also act, subject to specific regulations (including applicable authorization requirements), as: (i) electronic money issuers; (ii) liquidity providers in the virtual asset market; (iii) virtual asset market makers; (iv) financial service providers, in distributed ledger systems or similar systems, in connection with (a) servicesto issuers for structuring virtual asset offerings, and (b) financial advisory services, including analysis of the benefits and risks involved in trading virtual assets that the virtual asset intermediary does not offer.

3. Joint Resolution 14 and BCB Resolution 517, both dated November 3, 2025.

4. In addition, Bill 4,932/2023 is under discussion in Brazil’s National Congress and addresses, among other topics, the segregation of assets between virtual asset service providers and their users.